The State Of Header Bidding

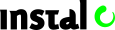

Header Bidding started to gain momentum back in 2015, and since then has become a go-to ad selling technique for publishers. Header Bidding has gained popularity over time. According to a report published by eMarketer in 2016, header bidding accounted for 73% of total digital ad spending and 48% of respondents agreed they were receiving higher CPMs than the waterfall method.

Here are some charts about the state of header bidding that will help you understand how the industry is responding to the matter.

Header Bidding Adoption

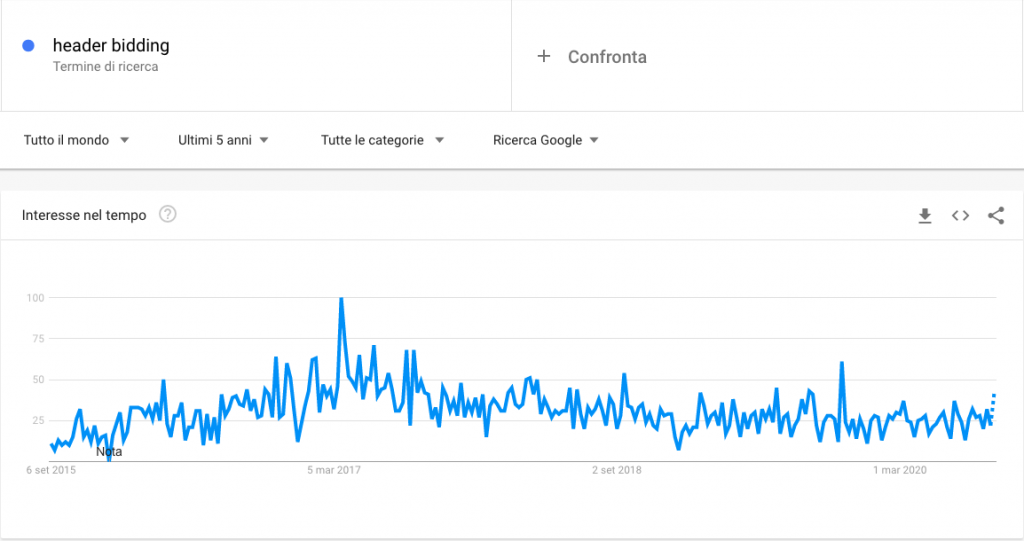

In March 2019, out of 1000 most popular US websites, 79.2% of publishers were using header bidding to monetize their inventories.

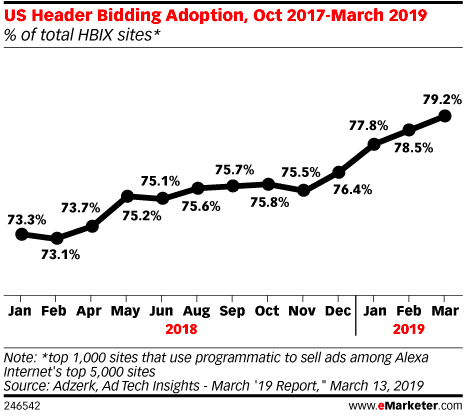

A recent report, published by AdZerk, in third-quarter 2020, almost 68% of US publishers were adopting header bidding, with an increase of 13,4% compared to the previous quarter.

Header Bidding adoption is constantly growing over time, and the reason is quite simple. Since it allows more exchanges to compete for the same inventory, publishers saw the prices of their inventory go up due to the increased competition. 48% of US publishers adopting Header Bidding have witnessed higher CPMs and 31% of them have experienced increasing yields.

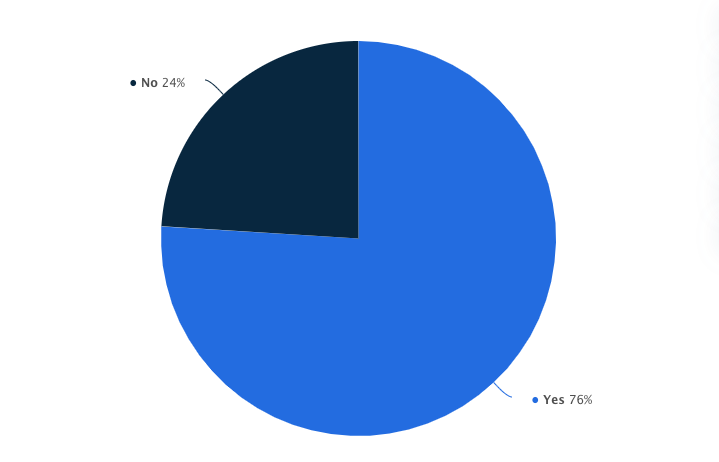

At the end of 2019, the share publisher sites using header bidding in their advertising technology stack worldwide was 76%.

Header Bidding Wrappers Adoption

A header-bidding wrapper is a code container ensuring all the bid requests are triggered at the same time and end on time. Almost 29% of digital publishers used in-house built wrappers to connect to multiple demand partners while 71,7% used a Pre-bid wrapper.

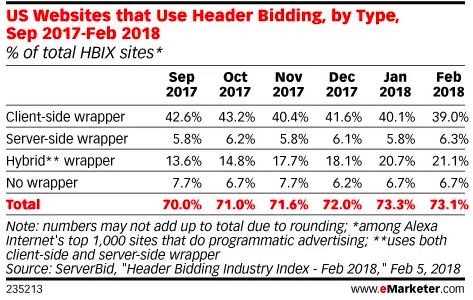

Looking at the client-side, server-side, and hybrid wrappers rate of adoption data is quite clear. Even if the server-side header bidding technology tries to solve the latency issues associated with the client-side header bidding, 39% of publishers did client-side header bidding while just 6.3% of publishers used the server-side technique to sell the ad inventories in 2018.

But, what are the wrappers that are driving growth in header bidding? According to the Adzerk Header Bidding Tracker, Index’s wrapper is used by the majority of publishers (23%) while Pubmatic and Rubicon’s ones occupy the 5th and 7th place in the TOP 10 US third-party wrappers list of Q3 2020.

Header Bidding Demand Partners

According to Adzerk, in 2019, AppNexus was the most widely-used demand partner for publishers, followed by Amazon and Index.

Header Bidding Adapter

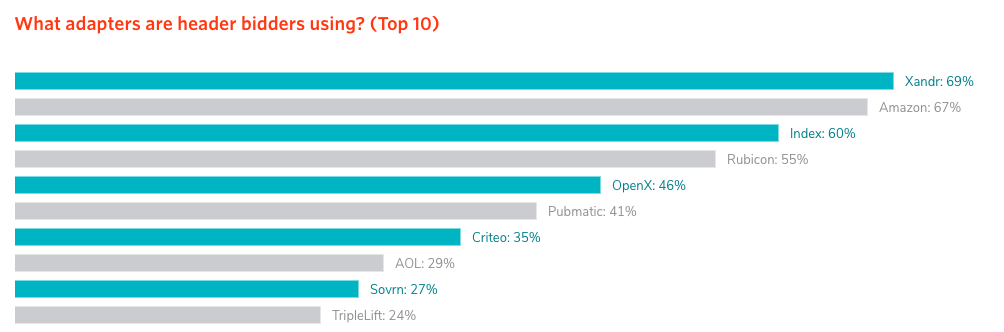

A prebid adapter is the demand partner-specific code that allows publishers to work with that demand partner and its partnered agencies and advertisers. In a nutshell, a wrapper is a container and it contains adapters. The most widely-used prebid adapter is Xandr (69%), followed by Amazon (67%), Index (60%), and Rubicon (55%).

Mobile Header Bidding

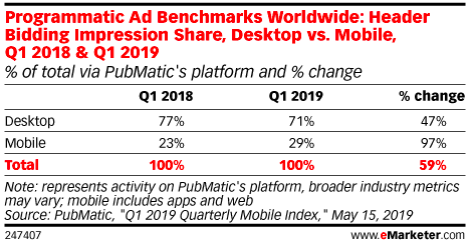

In 2019, a report published by eMarketer, based on research carried by PubMatic, found that 29% of header bidding impression share was served on mobile phones, while 71% via desktop.

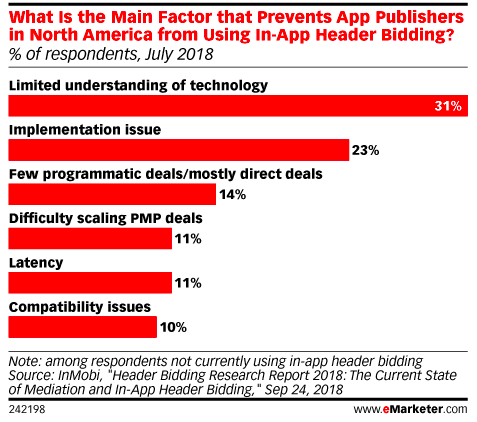

So what limits Mobile Header Bidding? Here is the pain point. 31% of US app publishers said that a limited understanding of in-app header bidding technology prevented the adoption, while 23% of the total avoid it because of the implementation issues.

Header Bidding and Transparency

The widespread adoption of Header Bidding has increased the level of transparency in programmatic bidding. Although certain iterations of header bidding can make it easier for vendors to hide pricing tricks, professionals seem optimistic about header bidding’s ability to bring greater transparency and ad quality to the programmatic industry. Header Bidding RTB advertising is an advanced technology that allows publishers to offer their ad inventory to multiple ad exchanges at the same time, instead of presenting the inventory in turns. Various advertisers bid simultaneously and in real-time, having the same bidding opportunities, allowing every publisher to sell every ad impression to the right bidder, at its true market value.

As opposed to the prior “waterfall method,” where ad networks are ranked based on their historical eCPM performance, header bidding effectively democratizes programmatic inventory access while making ad buying and selling more efficient and transparent.

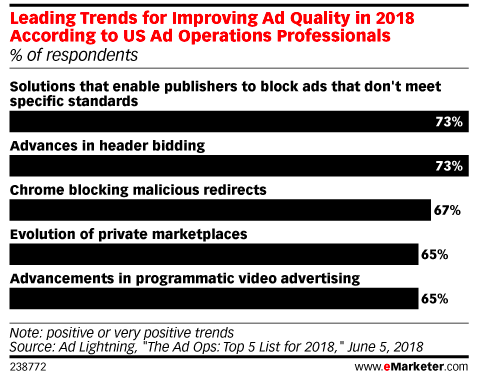

According to a 2018 poll, 73% of US ad operations professionals cited header bidding as a top trend for improving ad quality.

Conclusion

The rise of header bidding has completely changed the programmatic landscape. Until then, programmatic advertising had relied on the waterfall approach, where publishers’ true earning diminished due to the prevalence of the second-price model auction. This model satisfied the interests of advertisers in paying less for every ad impression, decreasing earnings for publishers.

Header Bidding benefits both advertisers and publishers. Advertisers get the right to access and pay for premium quality inventory before it is sold in the first rounds of the waterfall auction model, while publishers can increase their profits and maximize their revenues.

We provide publishers with an easy and independent platform developed to maximize revenues through an advanced header bidding solution. Our Instal for Monetization solution allows collecting data from the auction of every impression to predict and set optimal floor price rules across several ad exchanges.